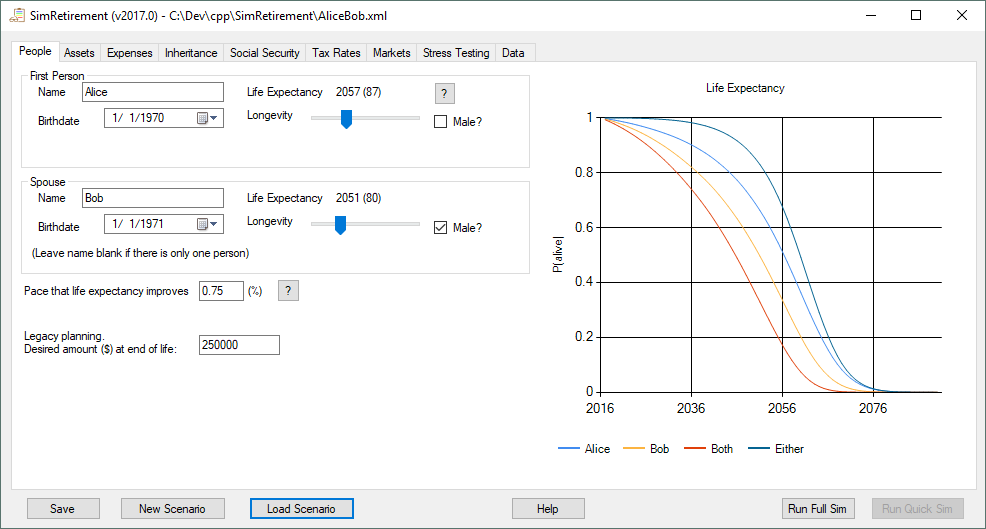

The main view showing the couple.

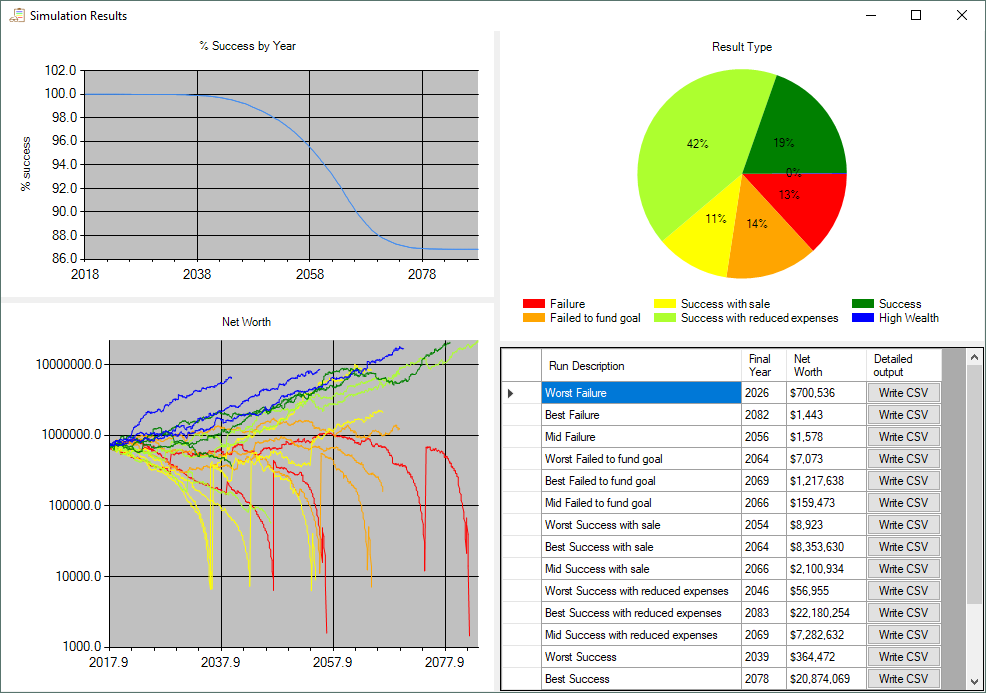

Alice and Bob have a 13% chance of running out of money before they die. They also have a 14% chance of not being able to fund a goal, an 11% chance of needed to sell their house and a 42% chance of needing to reduce their expenses.

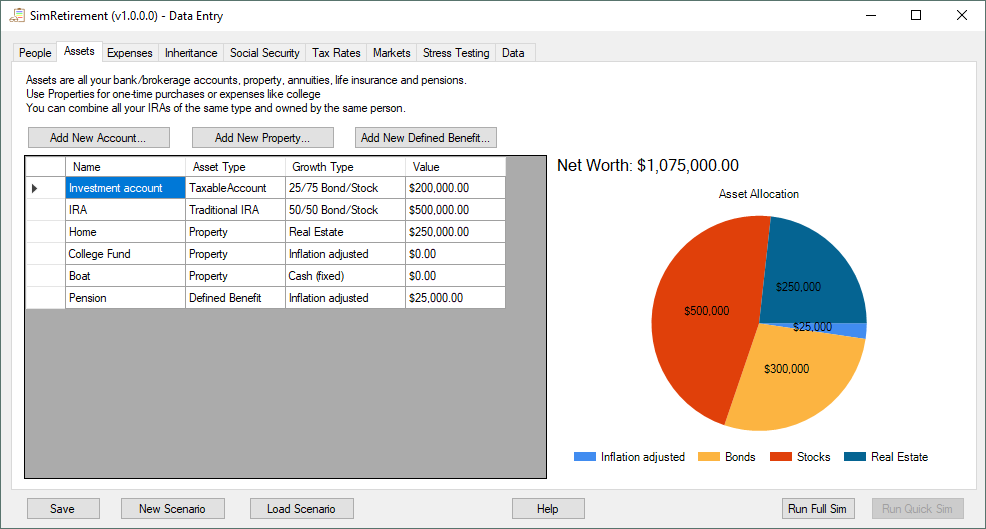

The program calculates your net worth once you have entered all your assets. It also shows a breakdown of your assets by type.

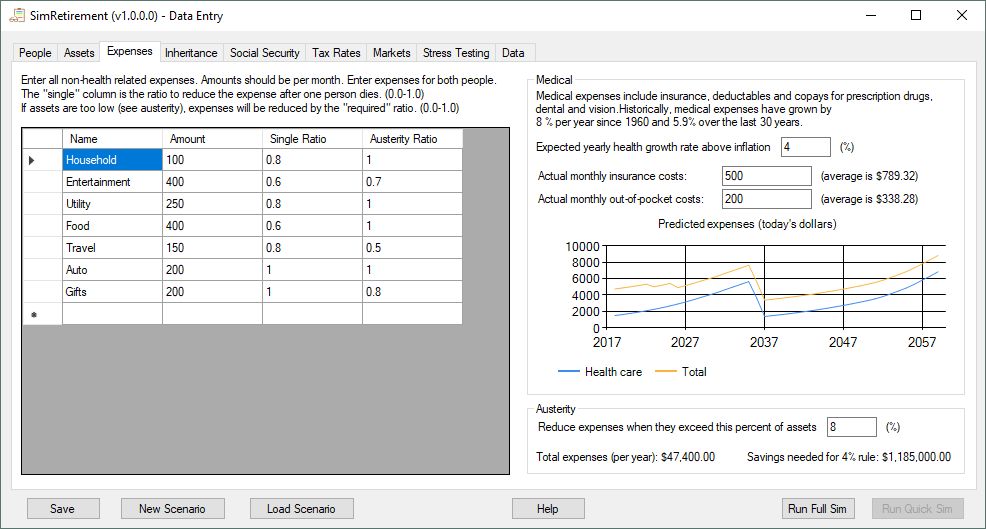

The couple has $1700 of monthly expenses and $700 of monthly medical expenses (plus some home maintenance, college savings and mortgage costs entered on the assets page). They will cut back their expenses if their expenses ever exceed 8% of their assets.

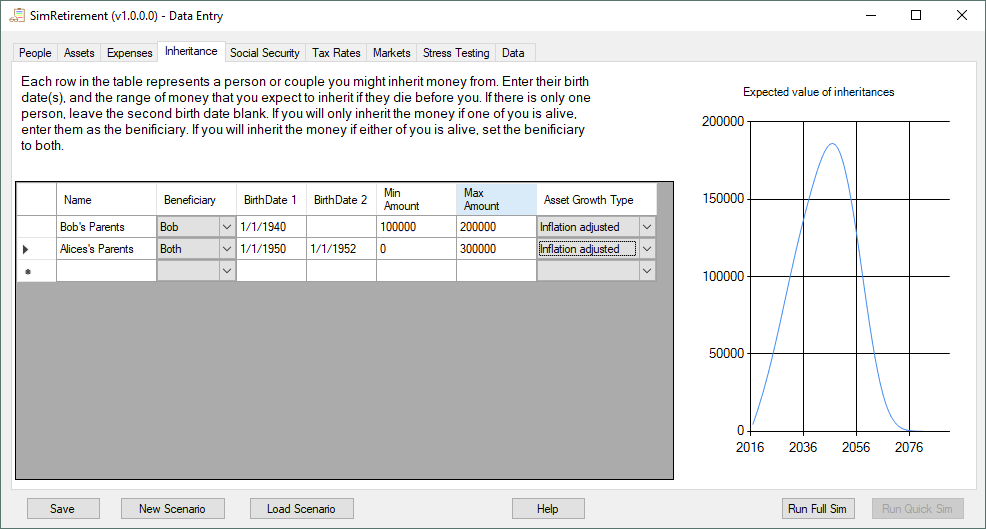

Bob�s parents may leave 100-200K to Bob. Alice�s parents may leave 0-300K to either Bob or Alice.

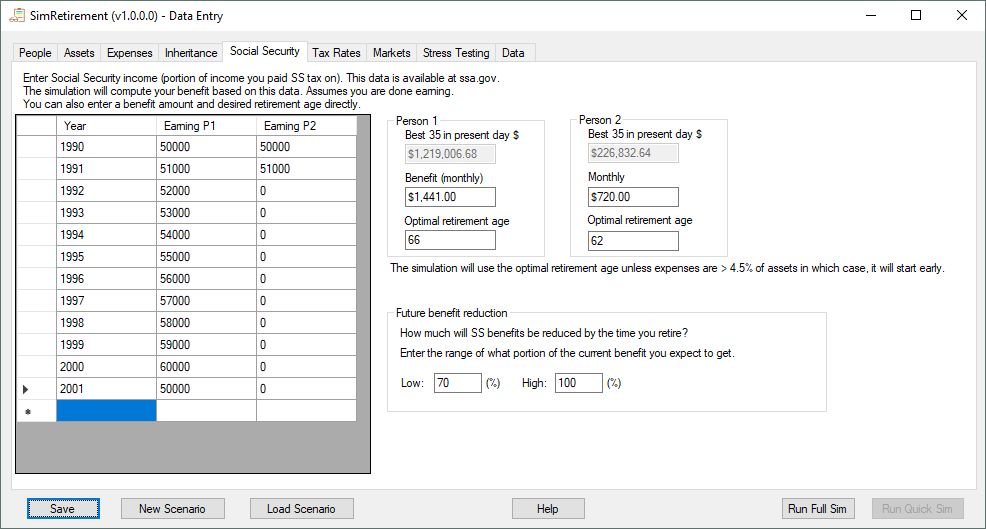

The second person is collecting Social Security equal to half the first persons benefit.

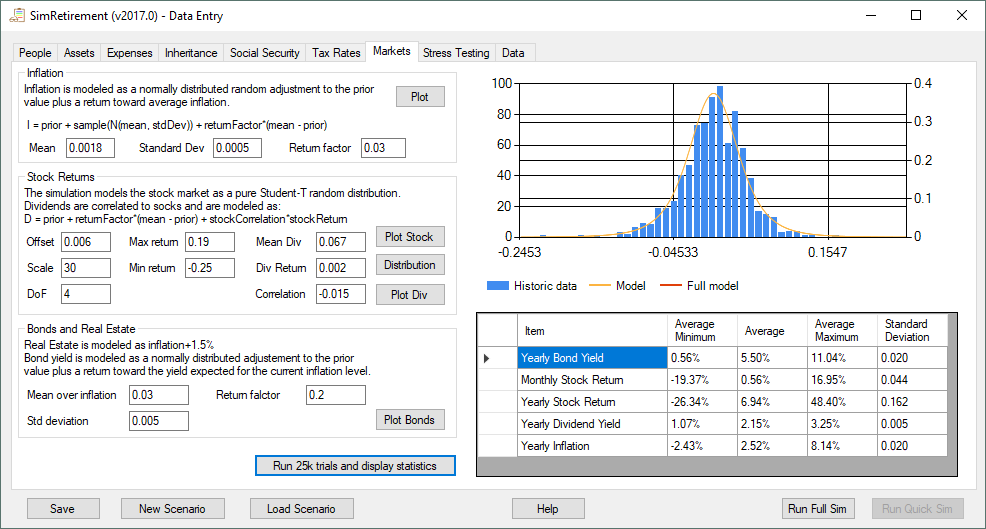

Setup the simulation of the stock market, inflation, bonds, and real estate.