Introduction

SimRetirement is an application to help you decide if you have enough money saved for retirement. The program works

by simulating your retirement month by month under a wide variety of external market conditions. In each of

thousands of simulations of your retirement, the external market (stocks, bonds, inflation, etc) is modeled in a

historically realistic, but random way. This method is known as a Monte Carlo simulation and gives you a

probability that your retirement will be successful.

Software

The program is available for Windows and is free and open source. No internet connection is needed and the program

doesn't send your data anywhere.

Features

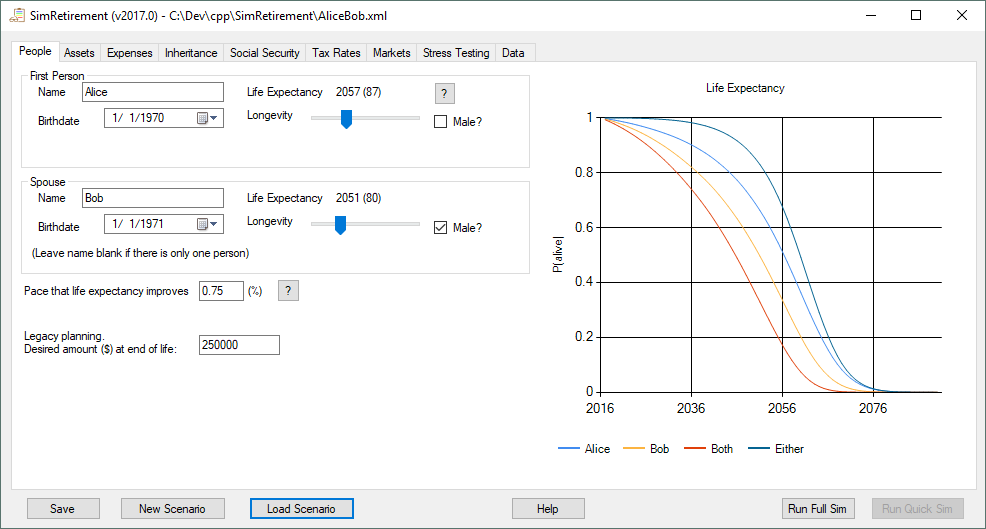

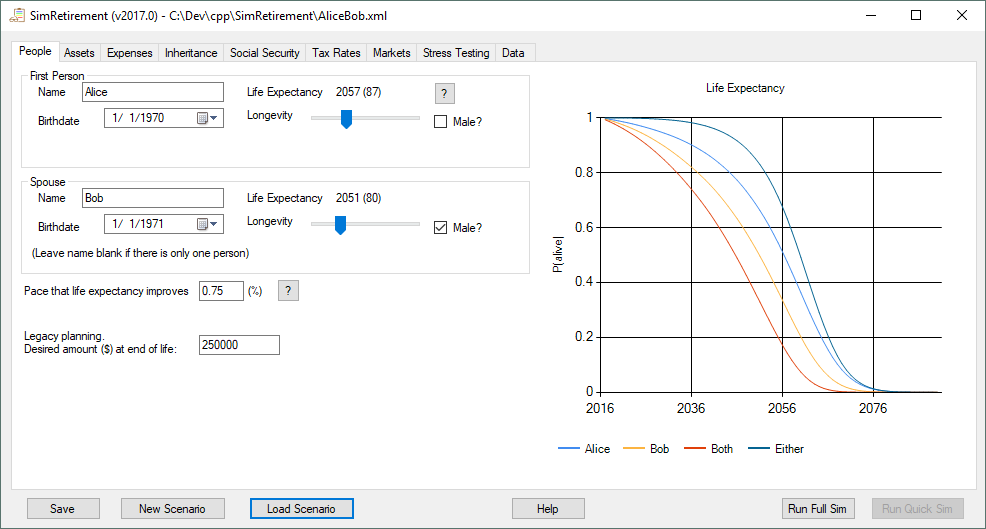

- Singles or couples

- Life expectancy treated as a probability

- Legacy planing

- Expenses

- Can be reduced if one partner dies

- Can be reduced if money gets tight

- Medical expenses can be set to grow faster than inflation

- Medicare replaces private insurance at age 65

- Assets

- Taxable, IRA/401K, and Roth IRA accounts

- IRAs can be set to have equal lifetime payments

- All accounts track basis and tax consequences of withdraws.

- Annuities and pensions

- Property

- Can be setup for purchase or sale during retirement

- Used to model one-time expenses like a college fund or vacation home

- Can be set to be sold if money is tight

- Inheritance - setup benefactors that have their own life expectancy model and beneficiary

- Social security

- Calculates your optimal start age - but starts early if you need the money

- Enter a range of possible benefit reductions due to changes in federal law

- Taxes

- Control how the external markets are modeled

- Detailed results of the simulation

- Probability of success over time

- Percent chance of high wealth/success/success with reduced expenses/success with property sales/success

with failed legacy goals or purchases/failures

- Get a detailed timeline of individual runs so you can see what happened

- Stress test your plan against historical scenarios